trust architecture

verifiable and immutable

a transparent investment platform

for securitizations

for a better world

for all investors

for all vendors

a powerful platform, for both traditionally issued and tokenized securities

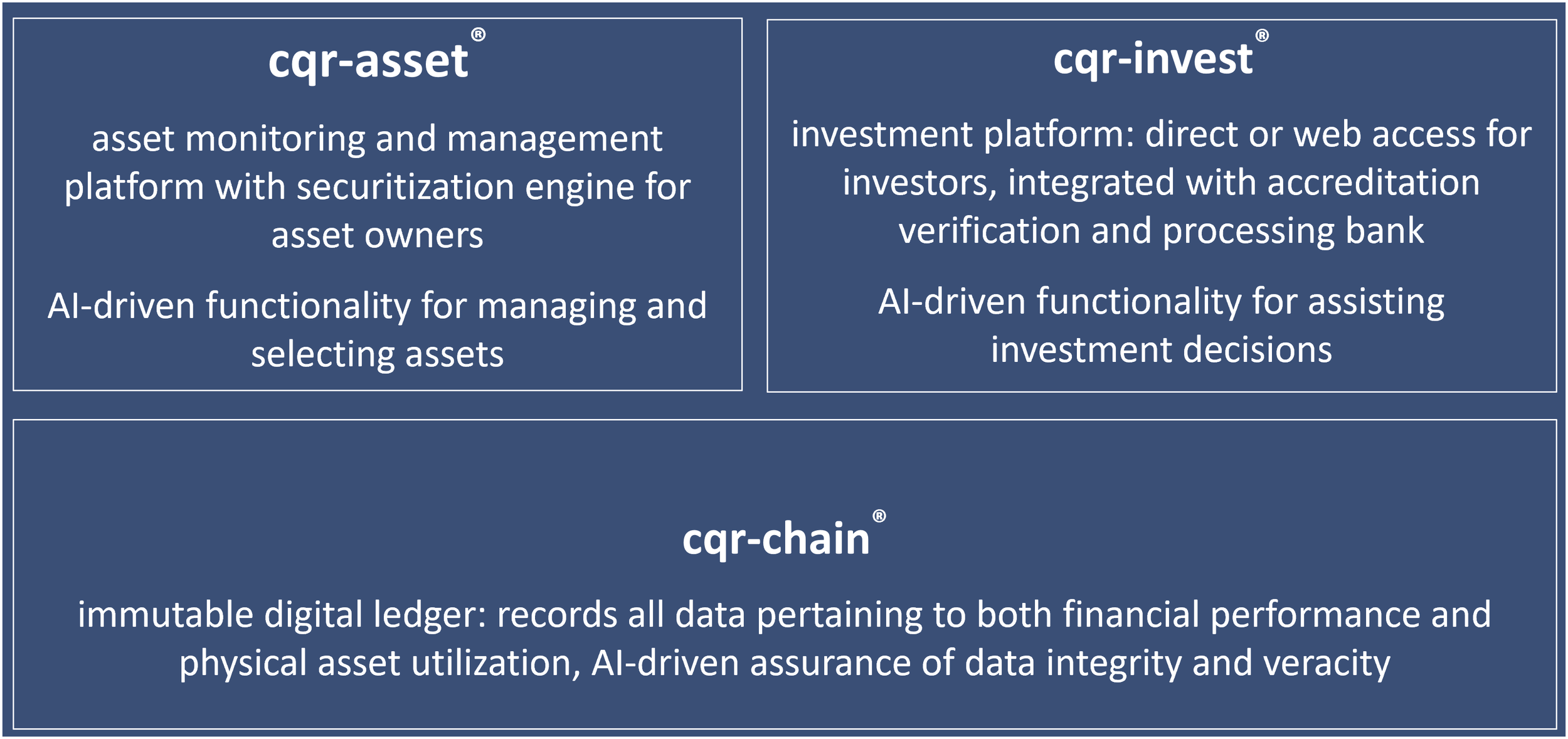

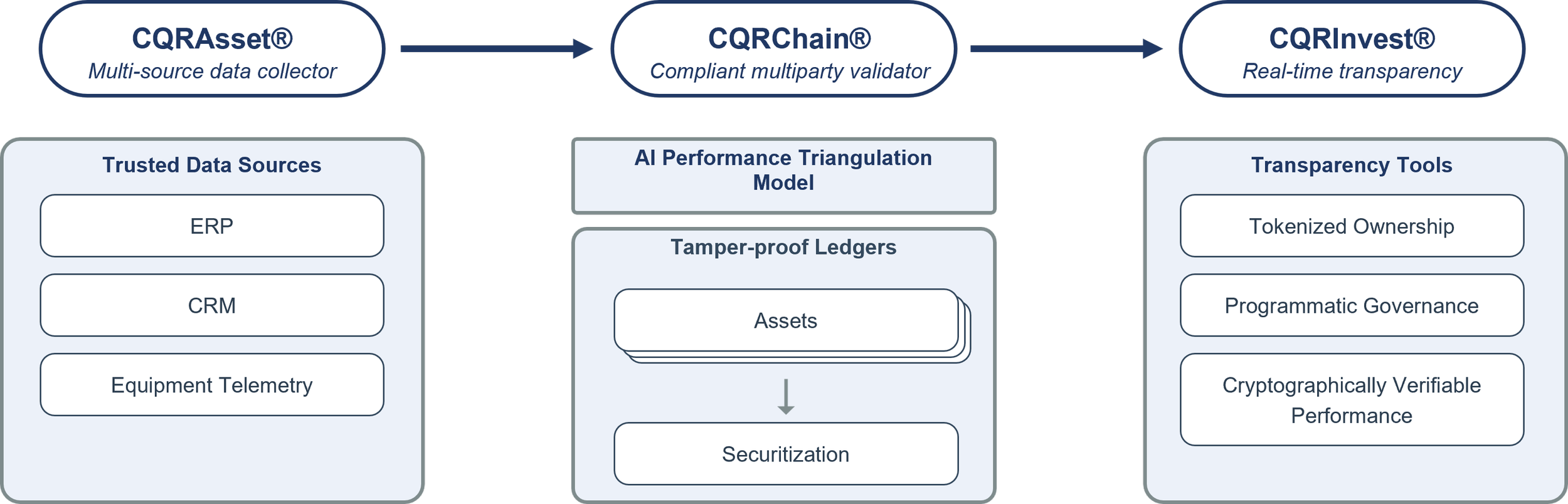

Powered by CQR-CHAIN®, Cathmere delivers comprehensive, audited, real-time data transparency—linking asset performance directly to investors through cqr-invest®, while asset-owners and issuers have access to their portfolios through cqr-asset®. The securities (investible instruments) are either issued traditionally, or in tokenized form.

allowing (accredited) retail investors to participate in the abs market

Through CQR-INVEST®, accredited retail investors will be able to invest in asset-backed securities and enjoy the benefits of these securities typically reserved for institutional investors.

providing manufacturers and large asset owners with visibility and direct access to capital markets

Asset-owners such as manufacturers (OEMs), energy project developers and leasing companies have direct access to investors through Cathmere’s platform, and full visibility on the performance of both the contracts and the physical assets through CQR-ASSET®.

untapped potential in emerging markets

Emerging markets hold enormous promise: growing populations, accelerating urbanization, abundant natural resources, passionate entrepreneurs, and increasingly skilled workforces. These economies also play a critical role in mitigating climate change. Yet too often, growth and climate goals are constrained by limited access to suitable financing—particularly the lack of viable pathways for refinancing debt.

yield alignment

While emerging markets face a funding shortfall, investors in mature economies struggle to find low-risk assets with sufficient yield to meet portfolio objectives. Institutional investors are seeking suitable instruments that align yield generation with positive impact.

bridging two sides of the global capital divide

Cathmere is building the bridge between high-impact opportunities in emerging markets and sophisticated investors seeking secure, yield-bearing exposure.

turning real assets into investable instruments

eliminates market opacity

provides automated verification of (physical) asset existence

allows continuous asset performance monitoring

creates investable instruments (securities), both traditional and tokenized

offers transparency to issuers and investors

creates dynamic, interoperable financial instruments

enhances liquidity

in-house developed

proprietary technology

combining

blockchain, AI, and IoT

(patent pending)

technology stack

our technology stack addresses five critical dimensions of the securitization lifecycle, each protected by proprietary methods and systems that create substantial competitive moats

Our provisional patent application includes innovations that:

transform blockchain into a real-time asset monitoring system

provides complete transparency to investors while protecting commercially sensitive data

reduce counterparty complexity

grant data access to tokenized securities

automatically trigger distribution across multiple blockchain networks